26th September 2024

Autumn Property

Market Report 2024

Autumn is now firmly with us and that usually means an upswing in the property market after a summer slowdown. 2024 has so far confounded the doom and gloom predictions at the start of the year, in fact we've seen a very strong market both locally and nationally.

The latest industry benchmark data from Rightmove shows the positive momentum is continuing and if anything it is actually picking up even more speed.

The traditionally busier autumn market has started early this year as last month saw good news in almost every corner of the property market.

Asking prices up

September saw average new seller asking prices rise by 0.8%, according to Rightmove. We usually expect a monthly rise in prices after the summer but this year it's double the long-term average, which is a clear indicator of where things are headed in the run up to Christmas.

Sales agreed are up by 27% year on year too, which means prices holding up are not putting off buyers. In fact more positive news for future sales is that the number of potential buyers contacting agents was up by 15% compared with September last year.

More choice

With all this good news for sellers there are also positive takeaways for buyers too. New sellers coming to market are up by 14% on this time last year, with the result that the average number of homes for sale per estate agent is at its highest level for ten years.

When there's more choice it does mean buyers can take their time and currently the average time for a seller to find a buyer is 60 days. Of course, if a property is priced keenly and a buyer wants to make sure they have the best chance of securing their dream home things can move a lot faster too.

Greater affordability

Greater affordability

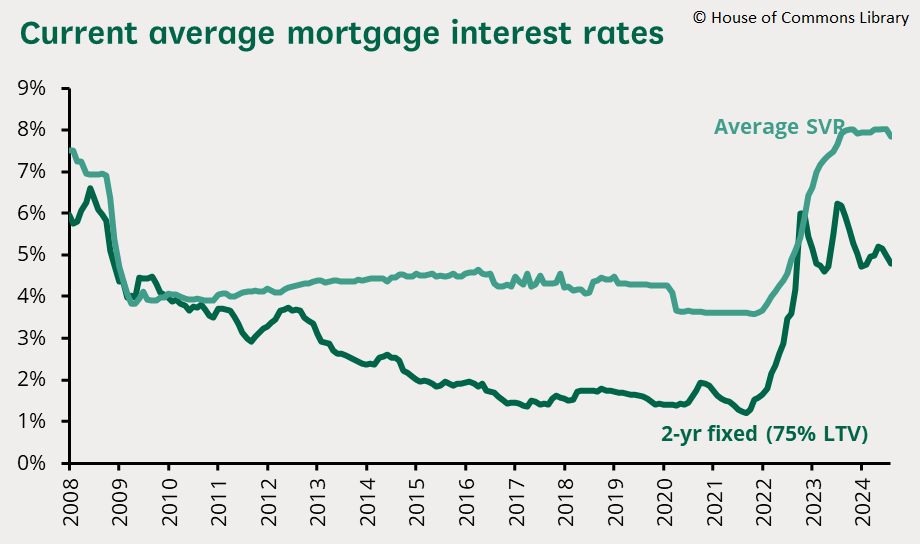

Although the recent first rate cut by the Bank of England definitely had a positive effect, the average 5-year fixed mortgage rate still stands at 4.67%. This is far lower than the peak of 6.11% in July 2023 but it's worth baring in mind that it's almost double the 2.34% rate that you could find this time three years ago.

However, with most commentators forecasting further BoE rate cuts sooner rather than later, mortgage rates are heading downwards and are likely to continue to do so over the coming year.

Another major factor that will benefit the property market is that earnings are now rising faster than both inflation and house price growth, combining to offer greater affordability for many buyers.

The last quarter

So now that we are in the last quarter of what has been a very busy year we wait to see if the new Chancellor's Autumn Statement on October 30th will have any announcements that affect the market in any significant way.

In Brighton and Hove we're seeing a reflection of the national figures and trends, although things here are always skewed a little by the fact that the local market is always busy.

Quite simply, people want to live here and it's what's happening at a local level that affects you if you want to sell or buy a home.

We continue to work across the whole of the city as we have done for a quarter of a century, while our office in Lewes Road maintains its status as the busiest and most successful in the immediate area.

So if you're interested in selling or buying a Brighton or Hove home talk to us - we are this city's experts!

Call 01273 677 001, email [email protected] or pop into our central office on Lewes Road to have a chat in person.