11th April 2023

Spring Property Market Report April 2023

Usually at this time of year any overview of the UK's property market would be packed full of details from the annual Spring budget. However, the latest economic statement from the Chancellor of the Exchequer was almost unique in having little or no direct actions that affect the buying and selling of property.

As usual, changes to certain tax liabilities and thresholds may impact some, especially those with large rental portfolios, but with no changes to stamp duty or other direct taxes specifically to do with property transactions the recent budget virtually passes us by.

In the news

Of course the Government's current lack of involvement on the housing market is only one aspect of the bigger picture and as is often the case the media seems to be doing their best to talk the sector down.

Recent reports in the last few weeks have highlighted some research claiming house prices have fallen quite significantly. As with many things, this really depends on who you ask...

Those particular 'news' stories are based on Building Society data, which for various reasons can at worst be misleading and at best often out of date.

In common with most industry professionals we use more detailed current data from the likes of Rightmove to get an overview. Most importantly, we rely on our own day to day experience of what's really going on in our area.

Ups and downs

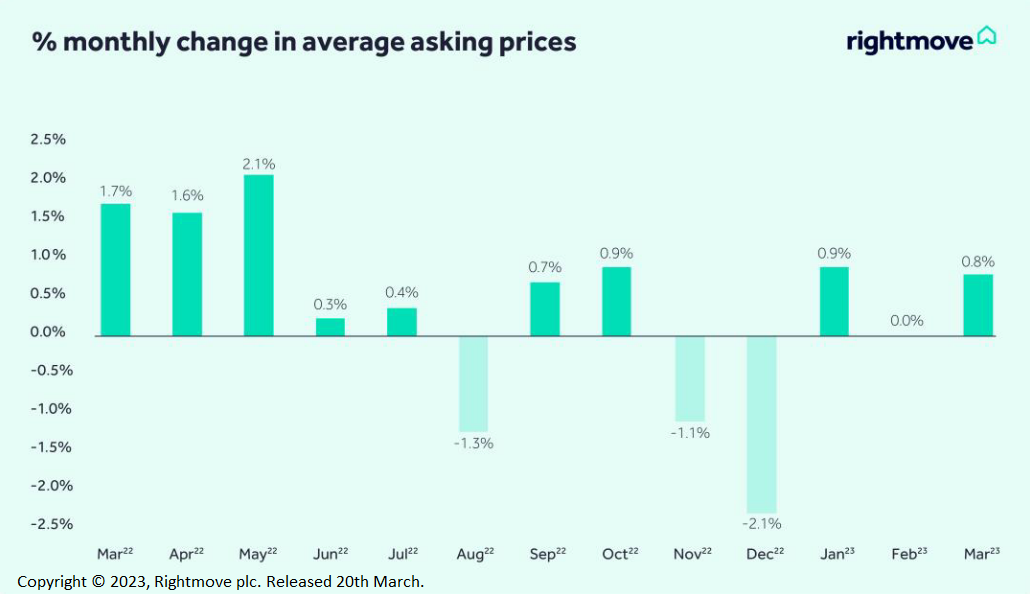

Righmove's 'House Price Index' report for March actually confirmed that the average price of property coming to market across the UK rose by 0.8% last month, with larger homes recording a 1.2% jump.

Typical first-time buyer type properties (those with two-bedrooms or less) lead the recovery as we enter the spring market. Average newly marketed prices for this type of home are now just £500 lower than their record high last year.

Sales agreed in the first-time buyer sub-sector were seen to be rising fastest, achieving figures close to the more normal pre-pandemic market of March 2019.

Elsewhere, there was good news for those seeking a mortgage. Average mortgage rates have fallen back from their peak last year with five-year fixed mortgages with a 15% deposit now at 4.65% as opposed to last October's 5.89%.

With the Office for Budget Responsibility (OBR) reporting that inflation is likely to reduce more quickly than previously forecast, hitting 2.9% by the end of 2023, there is widespread anticipation that the Bank of England (BoE) may reduce interest rates faster than previously expected.

Taking into account that on top of this BoE figures show that the number of mortgages approved by lenders rose in February, then things are definitely looking far better than a causal glance at the news might suggest.

Local matters

Of course

what really matters to anyone who wants to sell or buy a home is how all this

will really affect them. One of the big trends in property for 2023 is the way

'hyper local' issues are coming into play stronger than before.

Of course

what really matters to anyone who wants to sell or buy a home is how all this

will really affect them. One of the big trends in property for 2023 is the way

'hyper local' issues are coming into play stronger than before.

For instance, Rightmove's latest research actually shows prices HAVE fallen in London, although the national increases are reflected in our own SE region. Likewise, in London it now takes an average of 70 days to find a buyer, while here in Brighton our own experience is of much faster sales times right now.

Brighton and Hove has a very active property market and the areas we operate in are some of the most highly sought-after, so that's where the 'hyper local' aspect really matters.

As an estate agent with more than twenty four years experience of serving clients locally, we really know what's happening 'on the ground'. If you'd like to know how the market is evolving get in touch with our offices in Fiveways, Woodingdean and Lewes Road and we'll be happy to answer any questions you might have.

Fiveways

01273 566 777 [email protected]

Woodingdean

01273 278 866 [email protected]

Lewes Road

01273 677 001 [email protected]