26th March 2024

Spring Property Market Report April 2024

Easter always marks a turning point in the year and the seasons changing affects the property market just as it does every other aspect of life.

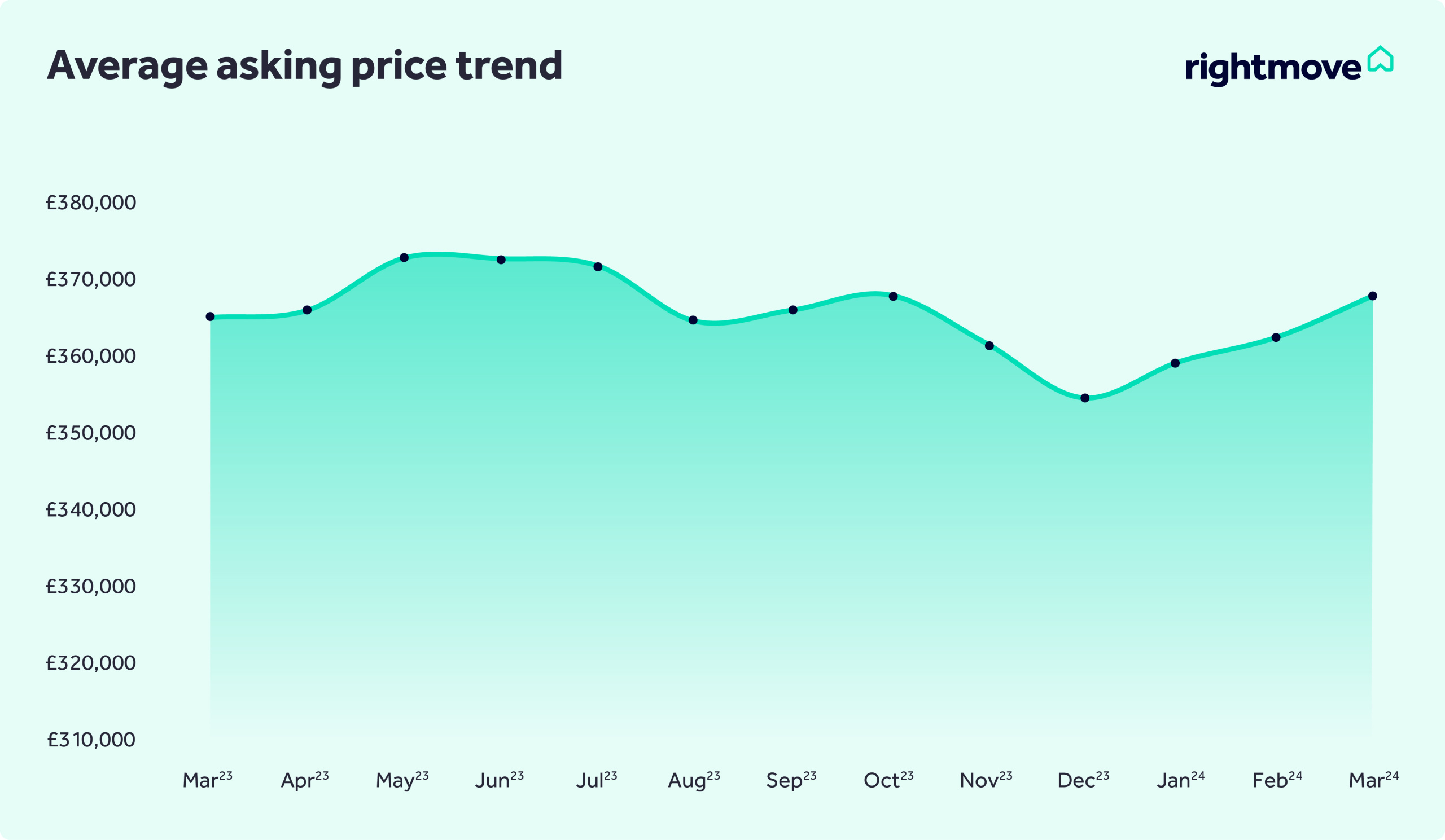

For one thing, it means the first financial quarter of the year is already behind us. So far 2024 has seen a strong and positive start. The number of agreed sales is outstripping those of the same period last year, proving on a local basis that sensible and competitive pricing is currently the key to a successful sale.

This kind of positive news from industry benchmark data provider Rightmove paints the picture in broad strokes, but what does it all really mean for those looking to sell or buy a home in the coming months?

Good news

In the main it's good news on most fronts. Although the recent budget was something of a damp squid when it came to anything to do with buying or selling property, the overall economic position is a favourable one for the market.

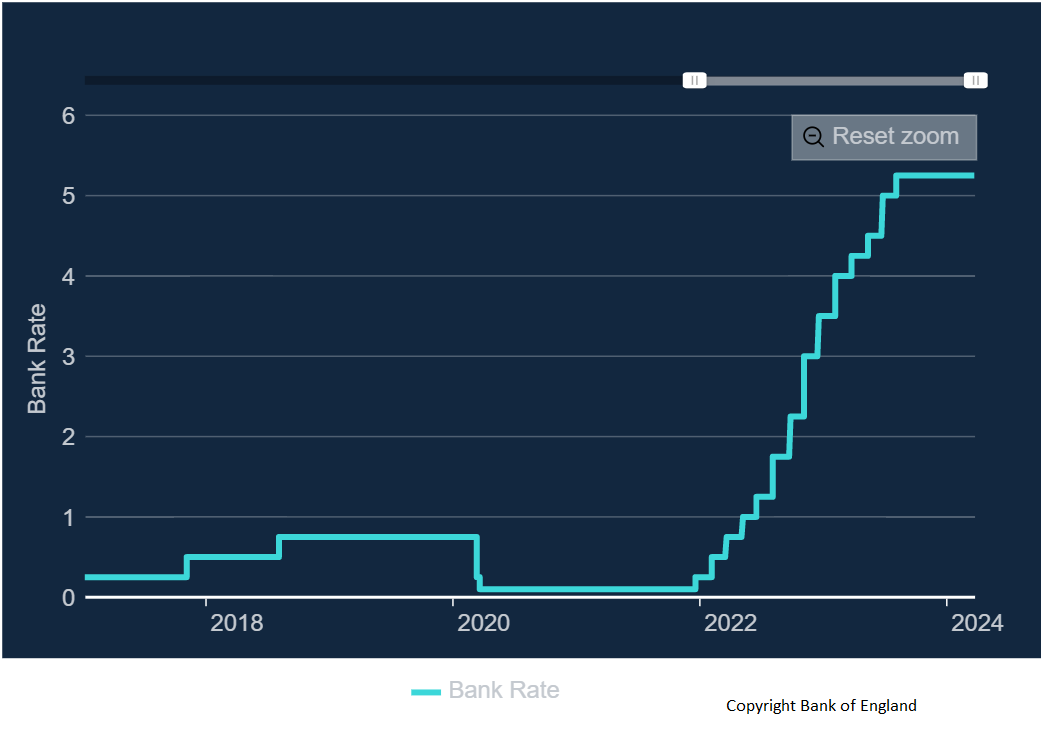

The latest decision of the Bank of England to keep their

interest base rate at a fifteen year high might indicate otherwise, but the

rates that matter are those set by lenders for mortgages.

The latest decision of the Bank of England to keep their

interest base rate at a fifteen year high might indicate otherwise, but the

rates that matter are those set by lenders for mortgages.

These have been falling for some months, so why is this? Essentially a mortgage rate needs to reflect where things are going rather than where they are right now, and inflation figures are tumbling and BoE rate cuts are widely expected over the coming months.

This means that mortgages are getting more affordable all the time and that's good news for both buyers and sellers.

Achieving a sale

Although prices and valuations are moving back up the fact is that it's something of a buyer's market right now. With mortgage rates still much higher than they were for a considerable period, people are taking their time to find the right property at the right price.

For anyone looking to sell their home, this means that they need to be realistic when it comes to pricing their property to going on the market.

With that in mind, property values have risen significantly

in the last ten years. Official figures from the ONS show the average UK house

price went up by 73% between January 2013 and January 2023.

With that in mind, property values have risen significantly

in the last ten years. Official figures from the ONS show the average UK house

price went up by 73% between January 2013 and January 2023.

So if you've been in your home for some time it's almost certain that your home is worth much more than when you bought it.

Brighton and Hove

Facts and figures that reflect national trends are always useful, however as always it's what's going on at a local level that really matters to anyone wanting to buy or sell a home.

Brighton and Hove has a very healthy, active property market and it's no surprise that so many people want to live here. As an established estate agency that has been working across the whole of the city for a quarter of a century we know every location extremely well.

We know why some people will want to live in a certain location while others fill favour somewhere completely different. The fact that Brighton and Hove offers everything from central-city living and suburban life right through to semi-rural settings really does mean there is something for everyone.

If you're interested in selling or buying a Brighton or Hove home talk to us - we can help!

Call 01273 677 001, email [email protected] or pop into our central hub on Lewes Road to have a chat in person.