11th July 2022

Summer Market Trends Report

With so much upheaval and uncertainty in the news headlines it can be difficult to get a good idea of what it all means for the UK property market.

It's our job to know where things stand and have a good idea of which way the winds may be blowing - that's why we like to offer quarterly market reports and updates.

Up or down?

With so much

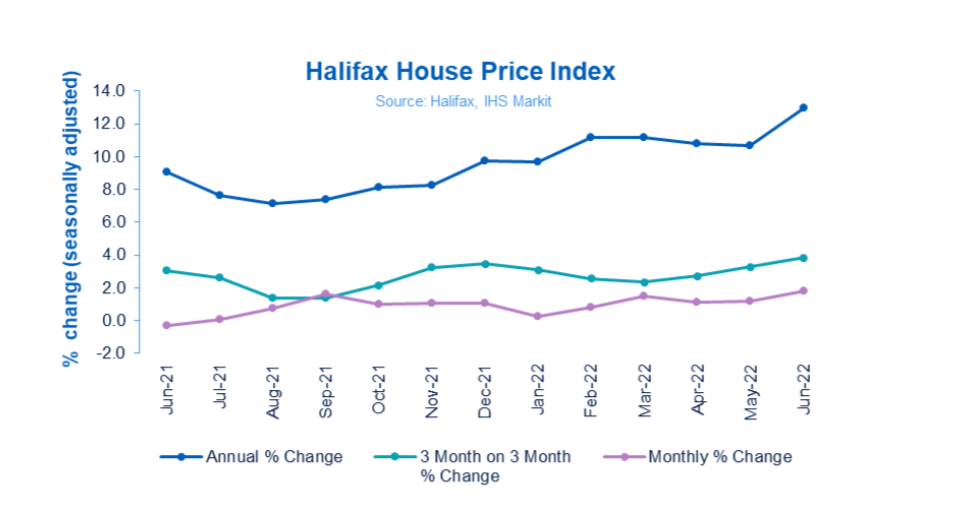

doom and gloom in the news outlets it may surprise you to find that house

prices have gone up every month this year. In fact they hit a new record high

last month, going up by 1.8% which is the biggest monthly increase since 2007,

according to Halifax Building Society.

With so much

doom and gloom in the news outlets it may surprise you to find that house

prices have gone up every month this year. In fact they hit a new record high

last month, going up by 1.8% which is the biggest monthly increase since 2007,

according to Halifax Building Society.

Elsewhere, the latest research from Rightmove revealed that demand from buyers was 6% higher than last year, more than double the pre-pandemic five-year average.

This means that the supply/demand imbalance continues to play its part on a property market that is still incredibly strong and favourable for sellers looking to secure a buyer quickly and capitalise on the fact that the typical UK house price has risen to yet another record high of £294,845.

For buyers there's good news too - the number of properties for sale was up by 7% compared to the same time last year, Rightmove data showed. That means there's more choice than there has been for some time now.

Signs and signifiers

That's where things stand and it's certainly a positive picture in terms of market activity, whether you're buying or selling.

However, developments such as the series of Bank of England interest rate rises in recent months can't be ignored. So what exactly are the real-world consequences of changes in the macro-economic environment?

The current base rate of 1.25% is now significantly higher than at the start of the pandemic when it stood at only 0.10% in March 2020. But to put things in perspective, only 15 years ago in July 2007 the rate was much higher than today's at 5.75%, so in fact the current figures are still extremely low!

You wouldn't think this was the case from the news reports and of course rates could still rise steeply in the near future.

The takeaway from this is that there's no time like the present to get a mortgage and to make your move if you want to buy property - we offer help and advice from ourindependent mortgage advisor Stuart Gulvin and it is absolutely FEE-FREE. Call him today on 01273 647 390 and find out why he and his team consistently get 5 star reviews and what he can do to help you get a great deal while they are still available.

Smooth sales

You may also have read about the current delays in the conveyancing process, which covers everything that happens after the 'sold' sign has gone up until the keys are handed over on completion day.

Due to the number of homes currently 'sold subject to contract' standing at more than half a million, which is 44% higher than 2019 and 39% more than the pre-pandemic five-year average, it can take 150 days to deal with everything at the moment.

That's why it is essential to have an estate agent that knows that their work continues after a sale has been agreed right up until moving day - that's another thing we pride ourselves on doing, minimising delays by making sure everyone involved in the sale from solicitors, surveyors, lenders and of course sellers and buyers know exactly what is happening all the time.

For help and advice in making your move this Summer call us today.