5th July 2023

Summer Property Market Trends Report July 2023

As summer really gets underway every July we're used to things slowing down to a certain extent. This applies across the board as schools break up, the weather hots up and holiday plans are finally put into action.

It's no surprise that the property market usually drops down a gear as well. This kind of seasonal change allows us to predict what's likely to happen at any given point in the year. It also means that by measuring changes against previous years we can get a good understanding of what's really going on.

A Warm June

The June we've just had was a nice hot sunny start to the

summer season and some reports are even claiming it was the hottest on

record.

The June we've just had was a nice hot sunny start to the

summer season and some reports are even claiming it was the hottest on

record.

As estate agents, over the summer we usually expect to see a modest drop in asking prices due to the usual 'supply and demand' process of how the market works.

However, it is worth noting that this seasonal drop seems to have started a little earlier than usual this year. Rightmove's latest report reveals that the first drop in ‘average new seller asking prices’ happened in June this year and that's the first time there has been a dip in that month since 2017.

As always, it's worth putting the actual figures involved into context and the impact of this reduction on average only equated to £82 per house, which doesn't even measure as a -0.0% point!

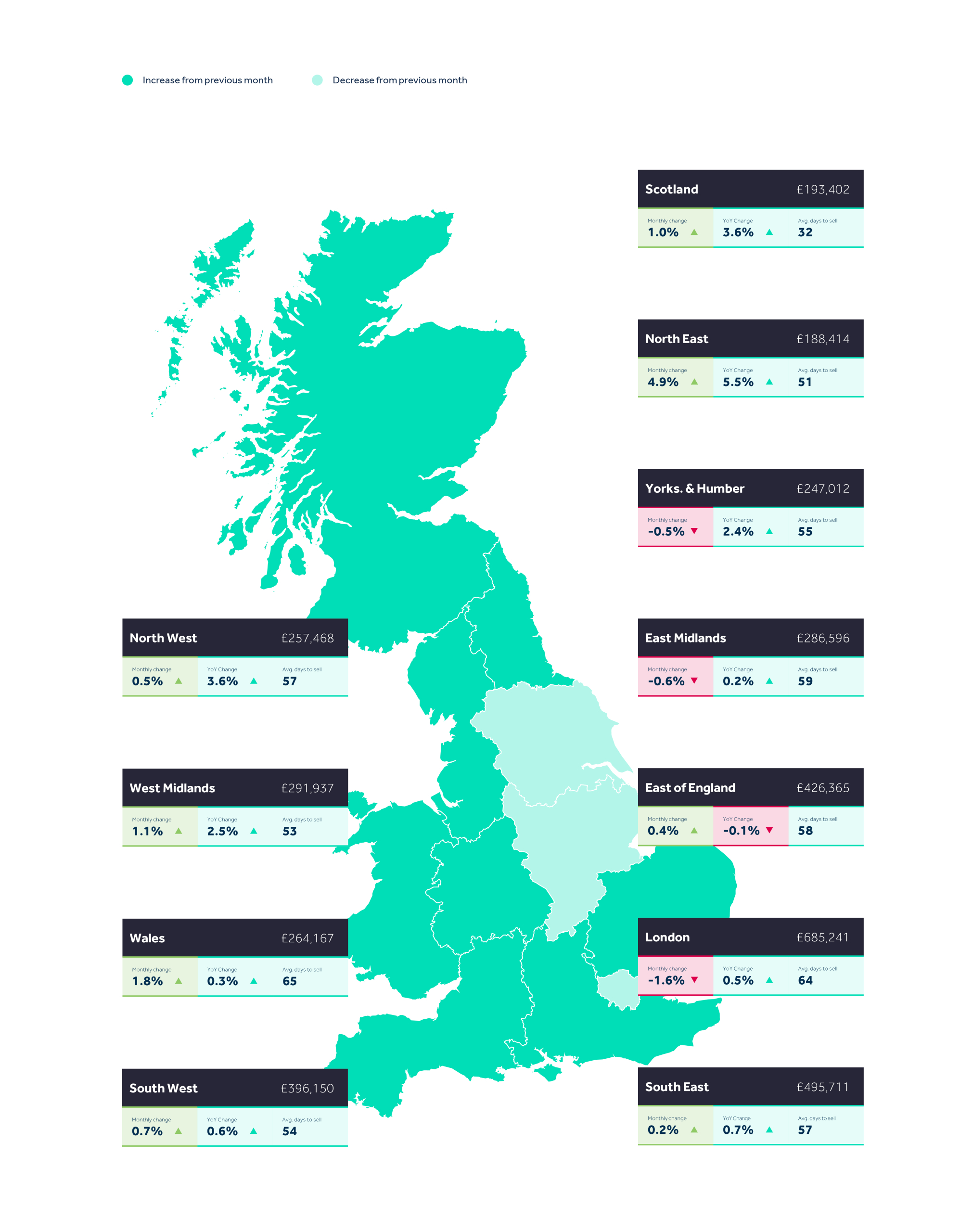

So why did the 'house price crash' headlines appear yet

again? Essentially this is because London properties bore the brunt of the fall

in prices, dropping by 1.6%. In contrast the

South East actually saw a modest rise of 0.2%.

Increase in interest

While seemingly ever-increasing interest rate rises being set by the Bank of England are quite rightly dominating the news, the effect on the housing market is still hard to quantify.

Rightmove's industry leading data reveals that the number of

buyers making enquiries to agents over the last two weeks of June was a

significant 6% higher than the same

period in 2019, the last pre-pandemic set of figures that we can use to compare

normal market conditions.

It seems that people are simply being more realistic about

long term monetary obligations when it comes to financing a property purchase,

so they are working out exactly how much they can afford.

By the same token, this means that sellers who price

competitively are likely to find a suitable buyer quickly. Essentially this is

exactly the same situation that we would usually expect to happen over the

summer months of any given year.

The hyper-local effect

In our market report at the start of the year we spoke about the expected rapid rise in interest rates for mortgages and we also predicted that one of the other big trends of the year would be the 'hyper-local' effect.

This is clearly reflected in the way that prices are going

up and down across the country, although it's the way it works on a much

smaller scale that should really be the concern for both sellers and buyers.

In Brighton this 'hyper-local' aspect really does matter and

as an estate agent with so much experience of working in our neighbourhood

areas we can tell you what's really happening on a street by street basis.

Get in touch with us and we can answer any questions you

have about the way national trends are impacting on our local property market

and exactly what that means for you.

Woodingdean: 01273 278 866 [email protected]

Lewes Road: 01273 677 001 [email protected]